Baygroup Blog

Welcome to our blog! Here you will find posts and comments from our experts. You can filter the posts by the related insurance products or author.

With so many people bearing the emotional and financial brunt of being a caregiver, we looked for the best tips to help ease the day-in-day-out stress that comes with such an important role.

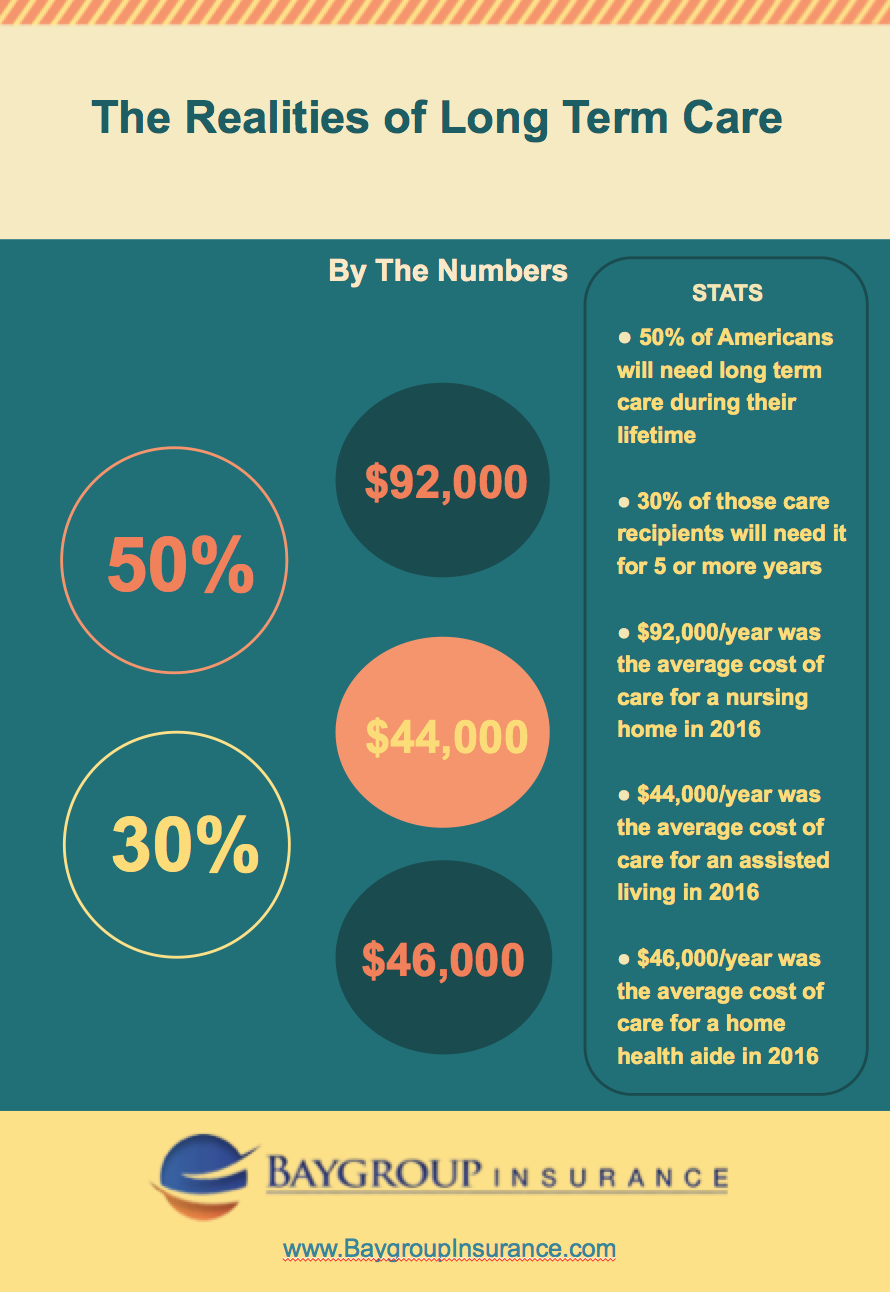

Long term care services include help with everyday tasks such as bathing, eating, dressing, using the bathroom, etc. According to a new study by LifePlans, Inc. on behalf of America’s Health Insurance Plans, 50% of Americans will need some type of long term care during their lifetime. About 30% of those care recipients will need it for five or more years. As health insurance does not cover this type of care, it is important not to underestimate the high cost involved.

The new year is set to bring in an unwelcome surprise for many seniors in America when it comes to their taxes. Those 65 and older who itemize their medical expenses will now only be able to claim a deduction once their cost reaches 10% of their Adjusted Gross Income (AGI)- up from 7.5% in previous years. This change technically went into effect on December 31, 2012, but if a senior or their spouse reached the age of 65 between then and December 31, 2016, the 7.5% rate was then locked-in for that time period due to a large opposition from seniors carrying the highest burden of medical bills. However, this all changes on January 1, 2017 when the 10% cut-off for medical expenses becomes the rule, not the exception, for everyone.

CLAIMS Plan Ahead and Let Your Family Know about your Policy

Although this is geared to federal employees who are evalating what to do about Federal Long Term Care rate increase, the process of evaluating what to do are the same for those with other policies.

Aging at home is increasingly the preferred method of care for seniors these days. In fact, a recent study by the Associated Press and the independent research organization NORC at the University of Chicago, found that 77% of adults ages 40 and over surveyed preferred aging at home.

According to a 2014 study completed by the American Association of Retired People (AARP), 80% of respondents wanted to age in their homes instead of moving to an assisted living or continued care facility. Considering there will be an estimated 73 million seniors ages 65 and older in America by 2030, this represents a very large number of the national population. Luckily, now more than ever, senior care trends are moving towards supporting the elderly in this endeavor.

Between an ever-shifting investment market and a plethora of recent changes to the long-term care insurance industry, a continuing care retirement community (“CCRC”) may seem like a beneficial way to plan for your long-term care. After all, the annual median cost of an assisted living facility for 2015 in the US rang in at $43,200, while the annual median cost of private room nursing home care in the US reached $91,250. A continuing care community therefore allows you to purchase independent living housing with the promise of being able to move into an assisted living or nursing home if the need arises.

According to AARP and the National Alliance for Caregiving (NAC), approximately 7.5 million Americans care for loved ones age 49 or over for an average of 41 hours a week. What many of these caregivers are unaware of is that respite care exists that would allow them time off from the often around-the-clock services they are providing for their care recipients.