The Realities of Long Term Care

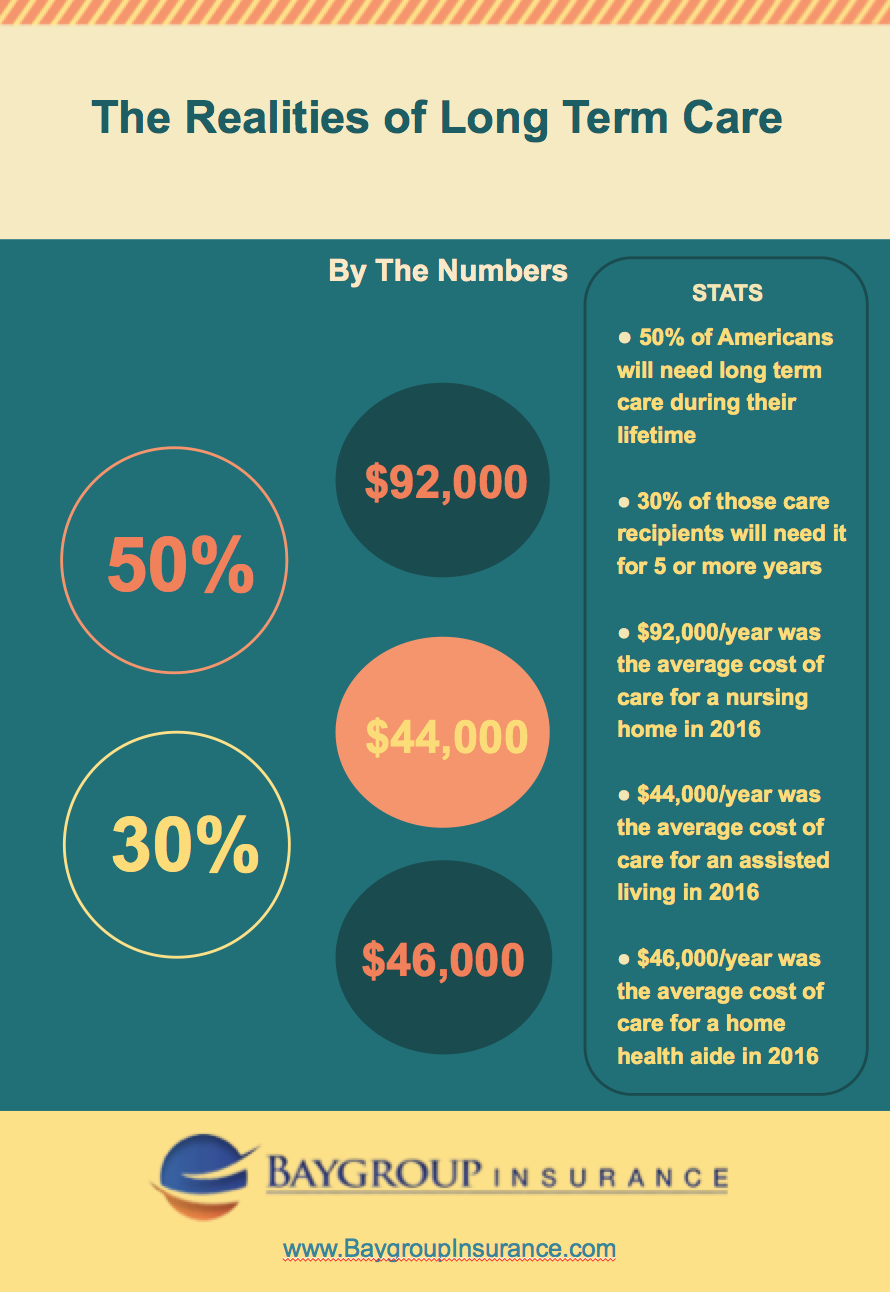

Long term care services include help with everyday tasks such as bathing, eating, dressing, using the bathroom, etc. According to a new study by LifePlans, Inc. on behalf of America’s Health Insurance Plans, 50% of Americans will need some type of long term care during their lifetime. About 30% of those care recipients will need it for five or more years. As health insurance does not cover this type of care, it is important not to underestimate the high cost involved.

Understanding the High Cost of Long Term Care

The average cost of care in a nursing home in 2016 was $92,000/year. Meanwhile, care at an assisted living ran an average of $44,000/year, while the average cost of a home health aide came in at $46,000/year. Of those surveyed, three out of five people underestimated the yearly cost of a nursing home. Those fifty years and older guessed that a nursing home stay in their neighborhood cost 27% less than it did in actuality. Health insurance often does not cover having help with non-medical, but necessary, daily tasks such as meal preparation, medicine reminders, cleaning, transportation to medical visits, etc. Additionally, if personal savings are used, there may be consequences for selling assets to obtain the money such as being taxed on using retirement funds, or, selling stocks and bonds when it might not be the right time in the market to do so. Furthermore, unless you pass Medicaid’s very strict rules to qualify for long term care, the government and/or Medicare will not help cover these costs.

Find a Plan that Works for You

A good option to help pay for these services is long term care insurance. Having long term care insurance can provide readily available funds to pay for the care you need without having to turn to personal savings or a family caregiver. A third of buyers indicated that their number one reason for purchasing long term care insurance was to protect their estate and assets. Another one in five buyers cited affordability of services as their reasoning. There are a variety of types of plans that are available to fit individuals’ needs and budget. On average, a long term care purchaser in 2015 was 60 years old, more likely to be married, college educated, working, and have higher incomes/assets. The median income of buyers is $87,500. However, there are different types of long term care insurance choices to best fit your individual situation: standard long term care insurance, life insurance or an annuity with a long term care rider, life insurance that you use the death benefit for a chronic illness, or a home health care policy, are all possibilities. Additionally, the benefit amount or features of the specific plan can all be customized to fit your own needs and preferences.

Get More Information

If you feel like you might be a good candidate for some type of long term care insurance and would like to learn more, contact Baygroup Insurance at 410-557-7907. Needing long term care will unfortunately be a reality for the majority of Americans. Make sure you and those you love are protected.

Sources:

Who Buys Long-Term Care Insurance? Life Plans. 1 Feb. 2017.

Caramencio, Alicia. Don’t Underestimate the Value of Long-Term Care Insurance. AHIP Blog. 1 Feb. 2017. <https://www.ahip.org/dont-underestimate-the-value-of-long-term-care-insu....